EVs are not enough – we must minimise private car ownership altogether

Cars in and around cities cost the environment, society, and the economy. Venture Capital can play a role in minimising them, but it must separate the signal from the noise.

The electrification of cars is picking up at pace, and now represents above 10% of global new car sales. New technologies are playing an important role in this transition, offering attractive investment opportunities for Venture Capital (VC) investors in such areas as smart charging and battery traceability & analytics.

But a sustainable mobility system means going beyond the electrification of cars. Whilst transitioning to Battery Electric Vehicles (BEVs) is essential to a sustainable mobility transition, the production of cars is itself still highly polluting. The emissions attributed to producing a BEV is around 15 tonnes of CO2e, versus under 10 for an ICE . Producing battery metals provides the bulk of these additional emissions, and often have further negative externalities including water use, burdening local biodiversity, and even child labour when supply chains are opaque and not properly managed.

The car industry must go beyond its electrification and recycled material targets, which, whilst essential to adopt, are alone not enough to meet our climate and materials decoupling goals. Current predictions see car sales nearly doubling by 2050 and their weight growing by 15% . This is expected to increase raw material use for cars by an estimated 60% if OEMs achieve a (highly ambitious - some even say impossible) 70% recycled content rate by 2050, and ~270% if they only achieve 30% recycled content.

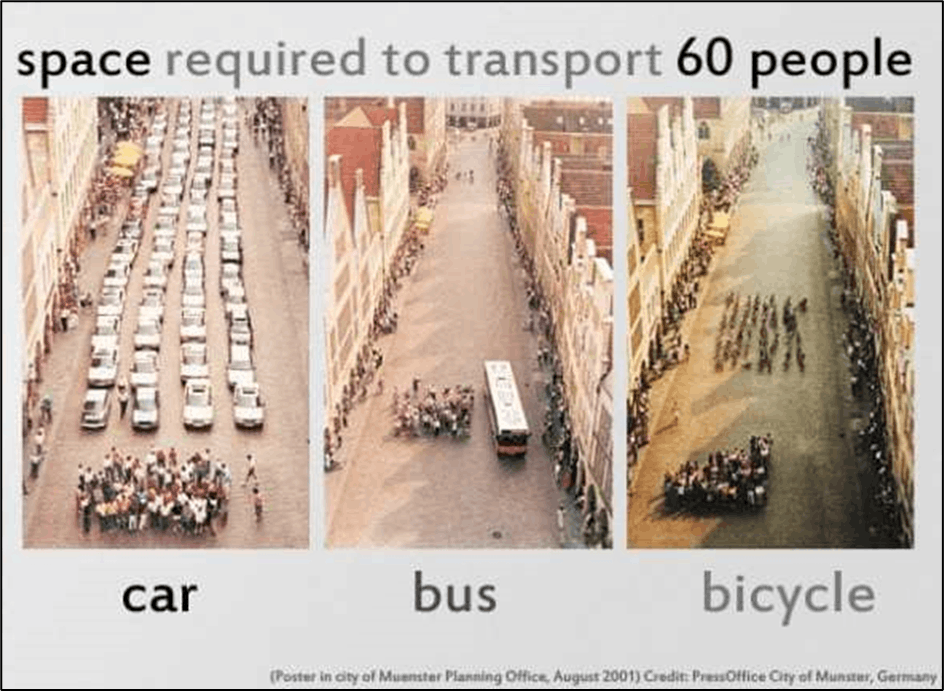

Operating too many cars on the road has significant negative external impacts too that go beyond environmental. C40 Cities Climate Leadership Group, an alliance, estimates that Asian economies lose an estimated 2–5% of GDP every year due to lost productivity from congestion. The average London driver spends 9.5 days in traffic every year . Inversely, it is no surprise that cities with fewer cars tend to be more habitable: there is less noise pollution, and space previously utilised for parking space & roads can be repurposed into people & planet friendly public spaces. Local commerce benefits from more space for pedestrians, and public health systems benefit from people moving more.

As with the electrification of cars, new technologies and business models have an important role to play in making cities more liveable without sacrificing convenience to its citizens and travellers.

But opportunities that are both highly scalable (i.e. attractive to VCs) and that meaningfully reduce car travel are limited:

- Micro-mobility solutions have a limited track record of taking cars off the road, as users typically use these to substitute public transport or their own bicycles

- Car sharing solutions, including peer-to-peer, have not yet effectively removed the need for car ownership and travel at scale. This may be because they offer only temporary travel solutions to travellers who, in many cases, need a daily, reliable, and convenient solution to get to and from work and drop their children to school. Car sharing does not lead to fewer passenger-kilometres driven. They may even cause higher per-passenger-km emissions than private cars, since users can be more reckless in the way they drive, leading to higher fuel consumption and faster depreciation (the moral hazard of “Don’t be gentle, It’s a rental”).

- Technology that informs passengers on intermodal travel often lacks offers built on top of these maps to incentivise more people to forego car travel

So where are the high impact, highly scalable investment opportunities? At Systemiq Capital we believe one such opportunity is in pooled transit underpinned by superior routing algorithms:

- High impact: An assessment of 800 peer-reviewed studies found that one of the most effective and fastest measures to decrease private car travel is to offer shuttle bus services for commuters. The Dutch city of Utrecht piloted such a programme and reduced private car transit by a whopping 37% .

- Highly scalable: improving routing algorithms are being applied to facilitate on-demand pooled transit. These routing technologies, which underpin a product typically licensed or sold as a software service (SaaS), offer a highly scalable, VC-investible business model. Their success is underpinned by the utilisation of their vehicles (typically vans or buses) – measured in vehicle passengers per hour (Passengers per vehicle revenue hour, or pax / VPH).

For example, The Routing Company has commercialised a superior routing technology inspired by research carried out at MIT. Their routing product sells to cities, corporates and universities to offer on-demand, pooled transit for their citizens, employees, and students. Their offering is particularly effective for first and last mile travel (for example, to/from a central train station), at universities and corporate campuses, and in poorly connected peri-urban areas. In developed markets, it allows cities to increase convenience and utilisation of transit while decreasing emissions and congestion. In fast-growing developing markets, it offers the promise of leapfrogging expensive and slow public transit projects.

To optimise the passenger experience, The Routing Company integrates real-time information that facilitates multi-model transport. This enables passengers to seamlessly transit from one mode of transport to the next, reducing friction.

As systems-change VC investors, we continue to seek out new technologies and business models that can significantly decrease car travel. Although car sharing has had a limited impact to date (as described above), solutions that could catalyse this model at scale have the potential to displace up to 15 cars for every shared vehicle if rolled out effectively. As such, we continue to scout for ground-breaking technologies and business models to catalyse uptake. Examples include better insurance and financing solutions, often underpinned by AI/digital twins and IoT to identify inefficiencies or incentivise better asset use.

Autonomous vehicles could also offer such a solution over time. At scale, these become highly efficient connected vehicles whose utilisation is maximised and coordinated. This in turn could lead to fewer parking spaces and fewer cars in tighter spaces (autonomous cars can tail one another) – provided that regulators put in place rules to ensure newly gained efficiencies are not over-compensated for by more consumption and thus leading to even more km driven (a classic rebound effect).

Ultimately, impact-driven investors must remember that there is no silver bullet and that decreasing private car travel is highly complex:

- It requires a multi-stakeholder approach:

undefinedundefinedundefined - The answer will look very different depending on the city archetype. European cities were originally designed before cars and trains were an option, making opportunities in scaling micro-mobility solutions more pertinent than many US cities that were originally designed for cars. Developing market cities are still growing, presenting a ripe opportunity to leapfrog the need for private car ownership & travel (which is comparatively still low) and scale, for example, on-demand pooled mobility where more traditional and expensive public transit systems do not yet exist.

But remember, despite this complexity, there is a universal truth: